Lake Murray at Sunset. Photo by Emma Jacobs.

Spirit of Opportunity

A spirit of opportunity prevails here in Lexington County, located in the center of South Carolina, complete with a warm sunny climate and a strong business environment.

We welcome you to come see why numerous businesses and industries call the County of Lexington home.

- Saxe Gotha

- Industrial Park

- The Saxe Gotha Industrial Park, home to Nephron Pharmaceuticals and two Amazon facilities, makes this Park ideal for advanced manufacturing, life sciences and other related industries.

- Learn More

- Chapin

- Business & Technology Park at Brighton

- With close proximity to Lake Murray, the Park borders Interstate 26 and is easy access to South Carolina’s key metropolitan areas including Columbia, Greenville, Spartanburg and Charleston.

- Learn More

- BATESBURG-LEESVILLE

- Industrial Park

- Featuring recent infrastructure improvements, the Batesburg-Leesville Industrial Park is less than 10 miles from Interstate 20 and is home to Fisher Tank and C.R. Jackson.

- Learn More

CENTRALLY LOCATED

IN THE HEART OF SOUTH CAROLINA

The County of Lexington, located in the geographic center of South Carolina and centrally aligned along the Eastern seaboard, is the beneficiary of a well-developed infrastructure offering quick and easy access to all forms of transportation.

- The County of Lexington

- Marketing Video

- Check out our latest marketing video, featuring all of the great amenities of Lexington County and profiling some of the major industries that call Lexington County home, including Amazon, Nephron Pharmaceuticals, Michelin and Tidewater Boats.

- The County of Lexington

- Industry Video

- Hear first-hand from our local businesses and industry partners on why they say the County of Lexington is a great place for doing business.

- Superior

- Lifestyles

- Residents from around the country have located to Lexington, drawn to the County’s small town charm, natural beauty, welcoming neighbors and an endless array of amenities and conveniences.

- Learn More

- Photo courtesy of Ralph Mayer

- Education

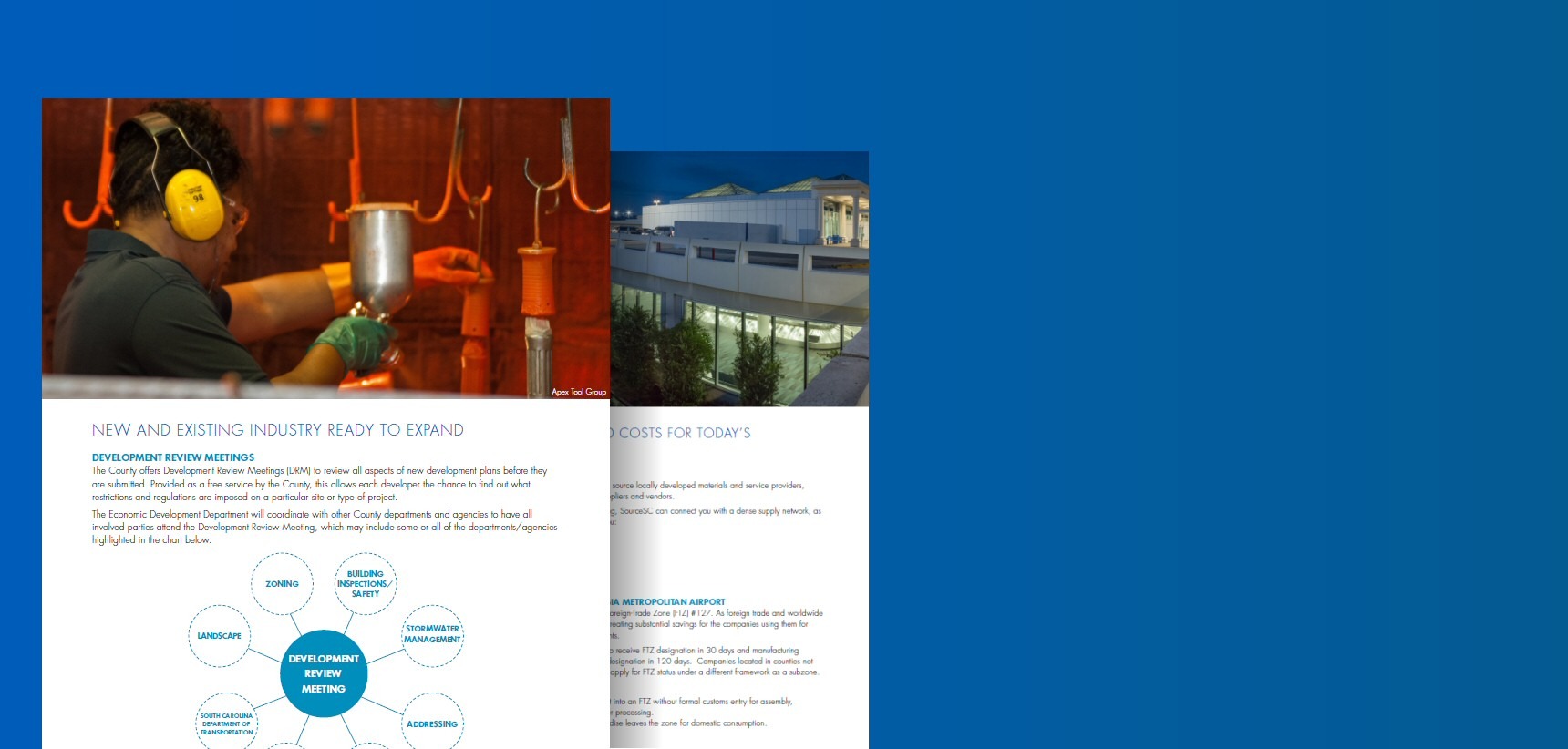

- PARTNERSHIPS AND TRAINING PROGRAMS

- Due to our high level of work-readiness and innovative workforce education and training programs, the County of Lexington is the perfect place for advanced manufacturing, automotive, aerospace, healthcare, agribusiness and more.

- Learn More

- 21st Century

- Workforce

- Our well-prepared, 21st century workforce is due to the tremendous support of government, business and educational leaders all working together to support new and existing industry in our region.

- Learn More

NEWS

Scannell Properties Sells Airport Distribution Center Speculative Building to CEEUS and Plans New Development

Colliers represented Scannell in the sale and will handle leasing and marketing for Airport Distribution Center II

Cooperative Electric Energy Utility Supply, Inc. Expanding Lexington County Operations

Approximately $52 million investment will create 61 new jobs

- The County of Lexington

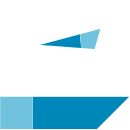

- Annual Report

- The 2021-2022 Annual Report from the County of Lexington Department of Economic Development.

- The County of Lexington

- General Brochure

- From thriving industry sectors to a growing population to ideal geography, this brochure outlines a multitude of reasons why there’s a spirit of opportunity in the County of Lexington.

- The County of Lexington

- BRE Brochure

- Our Business Retention & Expansion (BRE) program brochure features how our local, county and state government and economic development partners all work together to provide a business-friendly climate.

- The County of Lexington

- Executive Summary